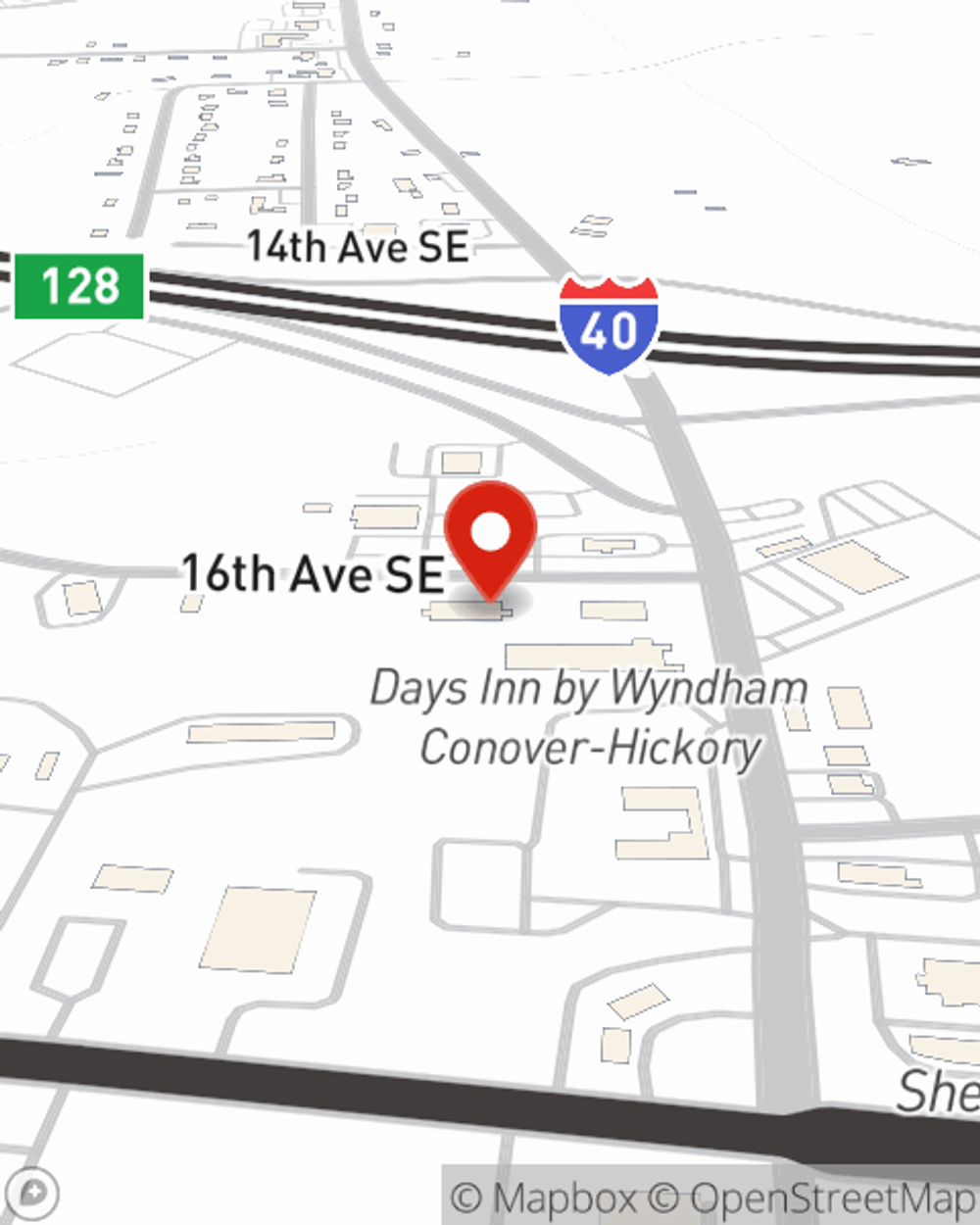

Business Insurance in and around Conover

One of the top small business insurance companies in Conover, and beyond.

Cover all the bases for your small business

- Hickory

- Newton

- Claremont

- Catawba

- Sherrills Ford

- Terrell

- Avery County

- Winston-Salem

- Buncombe County

- Taylorsville

- Charlotte

Cost Effective Insurance For Your Business.

Whether you own a a hair salon, a tailoring service, or a HVAC company, State Farm has small business insurance that can help. That way, amid all the different moving pieces and options, you can focus on what matters most.

One of the top small business insurance companies in Conover, and beyond.

Cover all the bases for your small business

Protect Your Future With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Sig Holcomb III. With an agent like Sig Holcomb III, your coverage can include great options, such as worker’s compensation, artisan and service contractors and commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Sig Holcomb III's team to learn about the options specifically available to you!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Sig Holcomb III

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.